Shuttering Hizballah’s Bank: Disruption or Diversion?

Lebanon’s closure of Hezbollah’s Bank, Al Qard al Hassan in 2025, is being hailed as a major disruption, but how much does it really weaken Iran’s hybrid threat finance network? This article explores whether the move marks genuine disruption or simply forces the system further underground.

Hawala in the Cloud, Cash Under the Mattress: ISIL’s Evolving Finances

We reviewed the UN’s 36th Monitoring Team report on ISIL (Da’esh), Al-Qaeda, and affiliated individuals and entities to identify novel developments and key issues related to terrorism financing. This commentary reveals how, even when traditional funding lines are disrupted, these groups diversify income streams, conceal assets, and adapt quickly to enforcement pressures.

ISIL Finance Chief Captured in Somalia

The capture of ISIL Somalia’s finance chief, Abdiweli Mohamed Yusuf, marks a significant disruption to the group’s financial leadership. This articles explores the implications for ISIL’s funding structure, including short-term operational impacts, intelligence opportunities, and potential ripple effects on regional groups tied to the Al-Karrar office.

Canadian Military Members Arrested on Anti-Government Terrorism Charges

On July 8, 2025, the RCMP charged four individuals (including active and former military members) with offenses related to forcibly seizing land as part of an anti-government terrorist plot. This article discusses the broader implications for domestic security and the ongoing trend of ideologically motivated violent extremism in Canada.

Digital Blow To Tehran: Hackers Disrupt Iran’s Illicit Finance Network

Commentary on how Predatory Sparrow’s cyberattack on Nobitex exposed Iran’s crypto lifeline, threatening IRGC terrorism financing and raising questions about long-term repercussions.

Greylisted and Red Flags: What FATF listings really achieve

This commentary reviews the FATF’s June 2025 gray and black list updates and provides a sneak peek at emerging analysis on their impact on terrorism financing. It highlights the ongoing need for empirical evidence to understand the effectiveness of these measures.

From Housekeeping to High Stakes: The Hidden Power of Canada’s Border Bill

Commentary on Canada’s 2025 Border Bill (Bill C-2) that promises to combat organized crime, money laundering, and fentanyl trafficking. While the legislation introduces changes like higher penalties and cash transaction bans, it raises questions about whether these measures will have any meaningful impact.

The Algeria Principles: A New Global Framework for Countering Terrorist Financing in Emerging Technologies

Early in 2025, the United Nations Security Council introduced the Algeria principles, a new global framework addressing the growing threat of terrorist financing through emerging financial technologies. This article explains why these recommendations matter - especially for professionals in FinTech, compliance, financial regulation, and national security - and highlights their role as a vital first step toward adapting policy and practice to evolving risks.

Canada Gets a Third* Terrorism Financing Conviction

Khalilullah Yousuf’s guilty plea in May 2025 marks another terrorism financing conviction in Canada and offers a window into the evolving mechanics of terrorist financing. The case involved a blend of traditional and modern tactics - from cash transfers and charitable causes to cryptocurrency and encrypted messaging - all within a transnational network. As Canada prepares for its FATF evaluation later in 2025, this conviction also reflects the country’s growing capacity to prosecute financial facilitators of terrorism.

Security and Intelligence Priorities for the Carney Government

What should national security in Canada look like under the Carney government? This commentary outlines four key priorities: RCMP reform, deeper intelligence partnerships beyond the U.S., better use of intelligence for economic security, and a stronger sanctions regime targeting criminal and cyber actors.

Digital Dark Money: A Critical Review of Terrorist Financing via Cryptocurrency

Despite rising concerns about crypto, most terrorist groups still move money the old-fashioned way. This book review explores how traditional methods like bank, hawalas, and high-value goods dominated terrorist financing from 2010 - 2020, and why emerging technologies remained secondary during that period. It’s a timely look at how evidence-based research can help narrow the gap between assumption and operational reality.

Trade Wars and Dirty Money

Trade wars reshape global markets, but they also open the door to financial crime. As tariffs shift supply chains and businesses look for workarounds, illicit actors exploit the chaos—moving money through shell companies, skirting sanctions, and fueling underground economies. This piece breaks down how economic conflict drives dirty money and what that means for financial and national security.

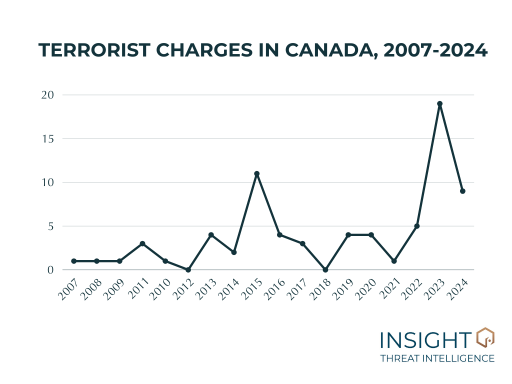

Terror on the Rise: What the Increase in Terrorism Charges in Canada Can Tell us About the Threat

Terrorism Charges in Canada are on the rise, raising questions about the evolving threat landscape. This article examines trends in terrorist arrests and prosecutions from 2007 to 2024, highlighting shifts in motivation, types of attacks, and the broader implications for counterterrorism efforts within the country.

Hamas Financing 2024: Key Insights and Analysis

We’re winding things down here at ITI for the year, so we thought we’d share a few of our major themes from the year, one of which is Hamas financing. While we did a lot of work on the group’s financing back in 2023 (including a series looking at how the group raises, uses, moves, stores, manages, and obscures their funds) and counter-terrorist financing options, 2023 was focused on debunking some myths and updating that analysis after a year of Israeli counter-terrorism operations.

Insight Monitor Dispatches: extremist financing through cryptocurrencies and a terrorist listing

We have a few updates for you this week that you might find interesting on extremist financing under a Trump presidency, the listing by Canada of the Houthis as a terrorist entity, and Canada’s upcoming FATF evaluation.

Canada’s $44 Billion Dirty Money Crisis

Canada’s underground economy moves an estimated $44 billion in dirty money each year, fueling organized crime, real estate speculation, and financial corruption. With loopholes in enforcement and regulatory blind spots, illicit funds continue to flow through casinos, shell companies, and real estate. As authorities scramble to crack down, the question remains—how deep does this problem go?

Funding the Flames: The Dark Side of Crowdfunding and Terrorism

From illicit trade to crowdfunding, terrorist groups find creative ways to fund their operations. This review breaks down the financial networks that keep them running, the loopholes they exploit, and the challenges in cutting off their cash flow.

ITAC: Canada's Integrated Terrorism Assessment Centre

Canada’s Integrated Terrorism Assessment Centre (ITAC) plays a crucial role in identifying and assessing terrorist threats. This piece explores how ITAC operates, its role in counterterrorism efforts, and the challenges it faces in an evolving threat landscape.

Foreign Interference Financing

Foreign influence isn’t just about diplomacy or espionage—it’s about money. Covert funding flows through hidden channels to sway elections, shape policies, and undermine institutions. This piece unpacks how foreign actors use financial networks to exert control and why it’s so hard to stop.

Podcast: Hamas financing after October 7th

Since the October 7 attacks, Hamas’s financial networks have been under pressure. This episode looks at how the group raises and moves money, the effect of sanctions, and whether global efforts to cut off funding are making an impact.